The open infrastructure for onchain asset management

Centrifuge’s real-world asset tokenization platform

brings the full power of onchain finance to asset managers and investors.

Working with

Why Centrifuge?

Centrifuge powers institutional-grade tokenization with automated infrastructure, multichain reach, and deep DeFi connectivity.

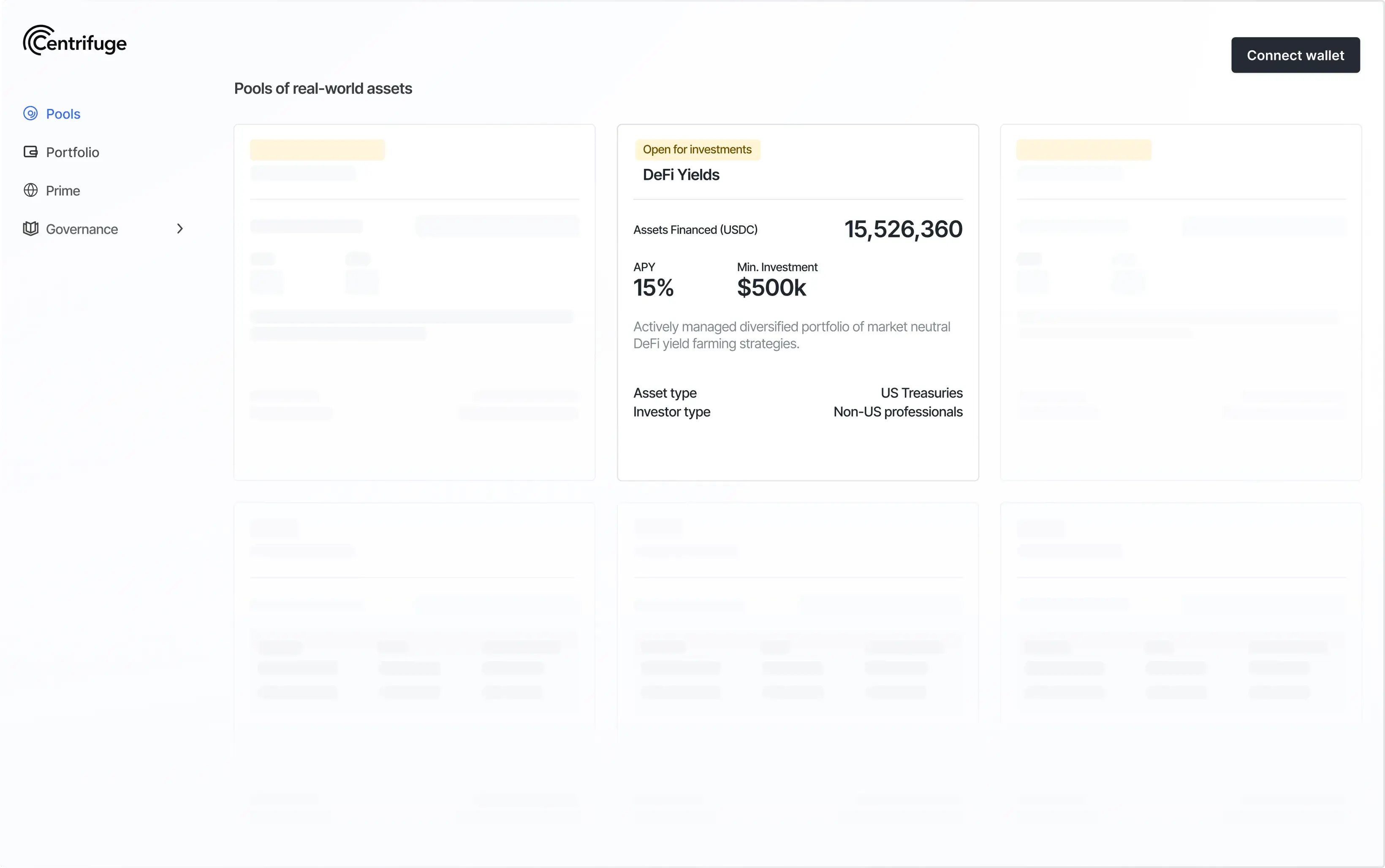

Institutional yield products

Tokenize and manage any type of asset - self-serve or via our whiteglove services.

Seamless DeFi connectivity

Access liquidity and secondary markets through integrations across DeFi.

Experienced and trusted team

Led by finance and tech pioneers with a proven track high adoption businesses.

Tokenize your assets with Centrifuge

Bring any real-world asset onchain with Centrifuge’s automated infrastructure. Streamline origination, reporting, and lifecycle management while accessing global liquidity through a transparent, compliant framework.

Tokenize funds, credit, treasuries, or other institutional assets

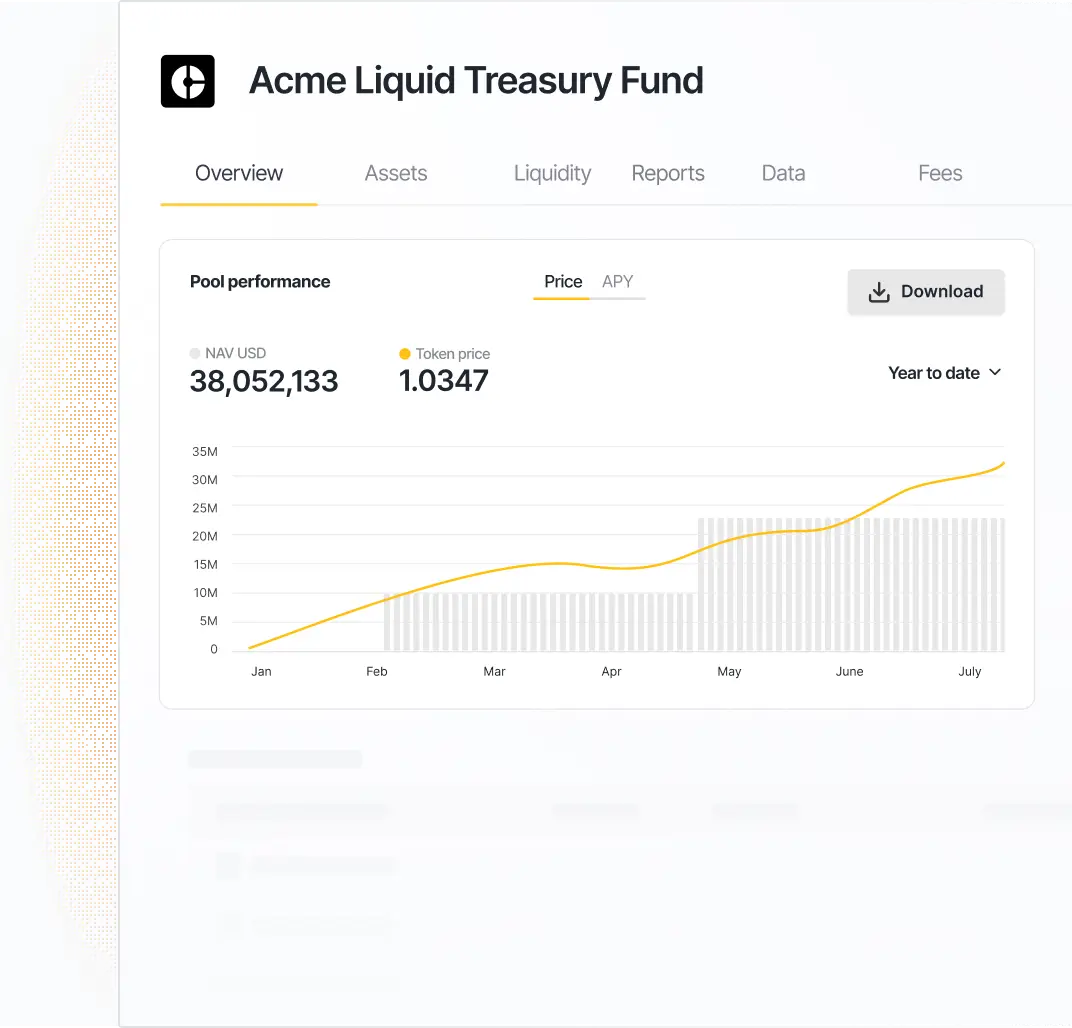

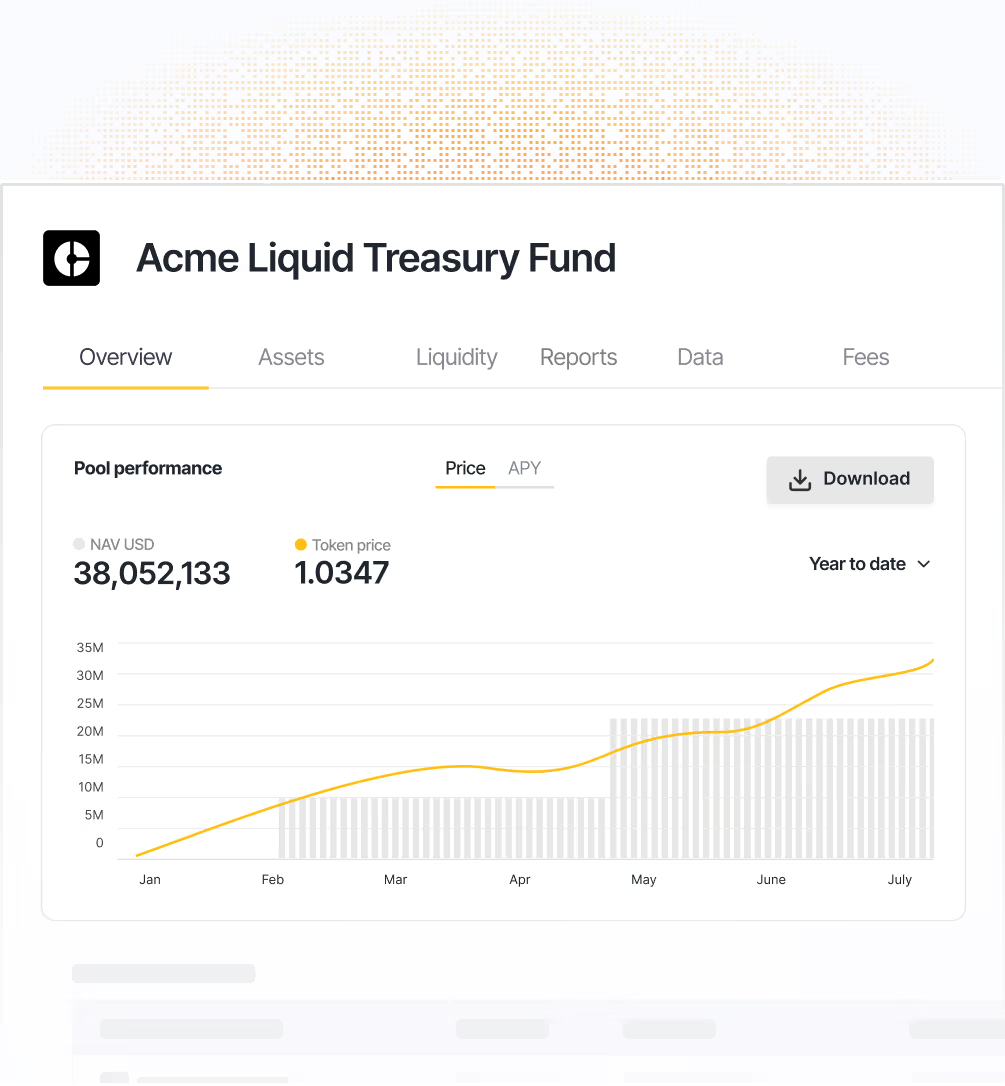

Access real-time, verifiable onchain performance data

Automate issuance, reporting, and portfolio operations

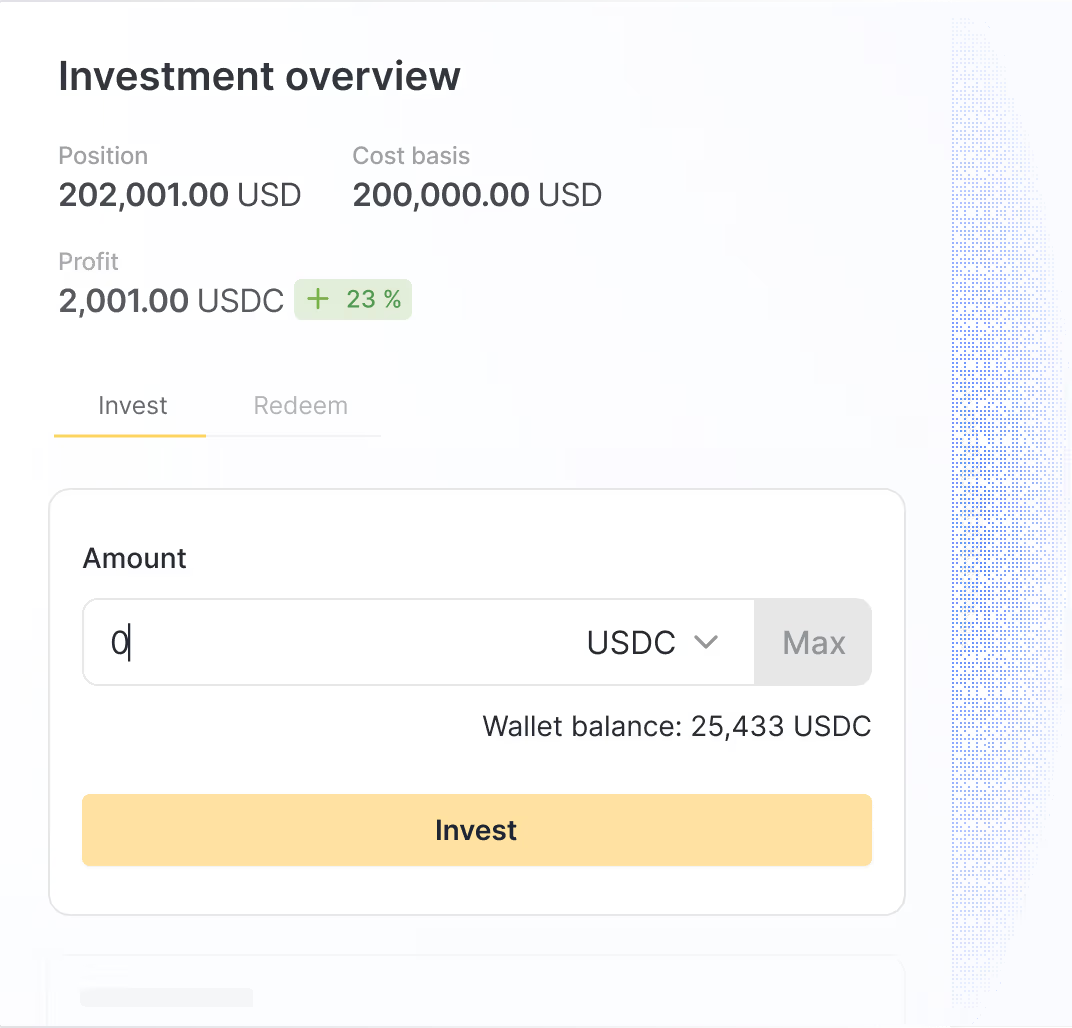

Access tokenized assets

Gain exposure to a wide range of institutional-grade real-world assets, from treasuries and credit to index products and structured vehicles. Centrifuge connects tokenized assets to DeFi liquidity, delivering transparent yield and diversified access.

Real-time onchain data on asset performance and holdings

Access from your preferred chain or currency

Transparent, efficient settlement and reporting

Ready to get started?

Centrifuge’s real-world asset tokenization platform brings the full power of onchain finance to asset managers and investors.