Centrifuge Reporting Features Set Benchmark for Onchain Transparency

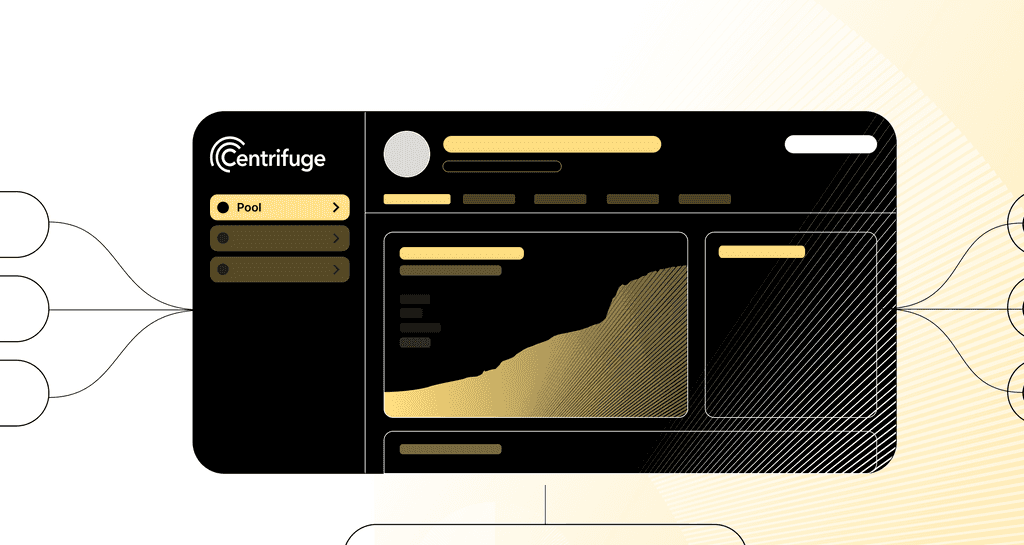

Centrifuge has launched a suite of advanced reporting features in its App, offering asset managers and investors unprecedented access to fully transparent, real-time, onchain data.

The institutional real-world asset lending market combines Coinbase’s layer-2 network, Base, and Morpho Vaults using three varieties of tokenized Treasury bills.

Read more…Centrifuge has launched a suite of advanced reporting features in its App, offering asset managers and investors unprecedented access to fully transparent, real-time, onchain data.

Opinion: I know it's not their nature, but US regulators could learn a lot by researching what overseas regulators have already done right.

Credbull's Onchain Private Credit Fund Will Be Available to Plume the Ecosystem via Centrifuge

Former BlueYard CFO Julia Merkel Joins as COO; Sonam Joshi Becomes Head of Product

Announcing our Series A raise and roadmap to propel real-world asset tokenization industry with DeFi composability and onchain utility.

Centrifuge, a platform dedicated to turning real world assets (RWAs) into loans, has raised $15 million in Series A funding led by ParaFi Capital and Greenfield.

Centrifuge’s first quarter of 2024: Our Fund Management Platform, continued cross-chain growth, protocol fees, RWA Summit updates, and more!

Celo ecosystem kickstarts activity with $1M investment in Anemoy's Liquid Treasury Fund

Celo’s investment follows Frax and Gnosis passing proposals to deploy $20M and $10M into Anemoy.

Announcing the launch of Centrifuge's fund management platform designed to onboard credit funds to public blockchains.

Centrifuge conducted interviews with experts to explore the current state, future, and endgame for stablecoins.

Centrifuge, the platform for onchain finance, today announced a range of news at the ETH Denver conference as it gears up for a momentous 2024.

Centrifuge predicts it will accumulate $4M in fees this year.

Tokenized assets pioneer Centrifuge is linking its Anemoy fund to Finoa’s 300-plus crypto institutions.

Medium exchange remains the “killer function” for stablecoins, Circle’s Stephen Leahy notes in latest stablecoin report

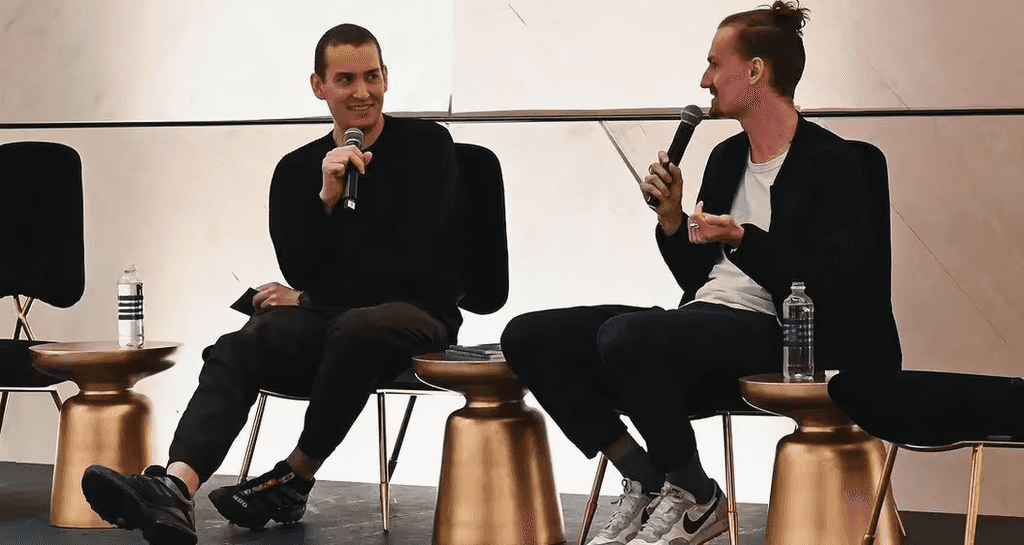

Martin Quensel of Anemoy and Cassidy Daly of Centrifuge discuss onchain treasury products in this episode of DeFi Drip.

Bringing together key players, TAC aims to drive more than $1 trillion in assets onchain

Centrifuge’s final quarter of 2023: DAO treasury allocations, cross-chain integrations, RWA Summit 2024, and more.

Stablecoin protocol leverages Centrifuge Prime, a service that provides the infrastructure for DAOs to invest in real-world assets.

Today, we share a number of announcements and updates as we closes out 2023 and head into the New Year with tremendous momentum.

We’ve pushed major improvements to the Centrifuge App, enabling multi-chain connectivity as well as sleek new Portfolio and Tokenized Asset pages—with more coming soon.

Web3 Foundation helps bring real-world assets to DeFi via Centrifuge with a $1m pilot investment in tokenized T-bills.

Web3 Foundation plans to up its real-world asset allocation in the future

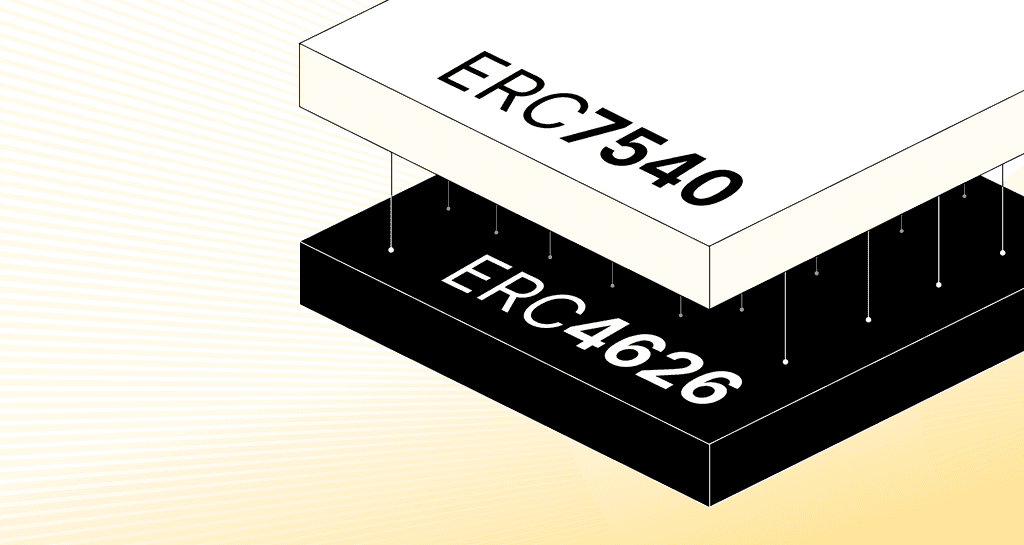

How Ethereum token standards can bring efficiency and composability for real-world assets (RWAs).

Centrifuge launched the Tokenized Asset Coalition to bring the next trillion dollars of assets onchain.

If EIP-7540 passes, protocols that have asynchronous workflows can benefit from yield-bearing vaults

We teamed up with Boys Club Founders Natasha Hoskins and Deana Burke to make real-world assets (RWAs) more accessible.

The Fixing Finance campaign merges the best of TradFi and DeFi while educating newcomers to Centrifuge's mission.

Dive into Centrifuge’s vibrant Q3: Cross-chain launches, The Tokenized Asset Coalition, Real-World Asset Summit, and more.

Centrifuge CEO speaks on the importance of creating better market infrastructure to bring tokenized assets on-chain.

Centrifuge's Real-World Asset Summit united TradFi and DeFi to shape the tokenized asset industry. Here's what we learned.

Centrifuge announces cross-chain launches, new ecosystem partners and institutional-quality assets to meet rapid demand for Real-World Assets

Centrifuge Liquidity Pool testnets have launched on Arbitrum and Base, with plans to release on other networks in the future

Liquidity Pools allow users on any supported chain—beginning with Ethereum, Arbitrum, and Base—to invest in Centrifuge’s pools of real-world assets.

Members Include Circle, Centrifuge and Goldfinch

Centrifuge Governance: Mandated Groups, Active Contributors, and the CFG Token

How the Centrifuge Credit Group provides risk analysis for new pools on Centrifuge, utilizing methodologies from years of experience in credit.

The Centrifuge Credit Group is a team of experienced credit experts who help onboard the best real-world assets to Centrifuge.

Long one of crypto’s big ideas, tokenization may finally be ready for prime-time. Wall Street is diving in, creating tokens for everything from buildings to gold bars.

Centrifuge in Q2: two major product launches, growth in onchain credit dominance, the inaugural RWA Summit, and more.

At the Real-World Asset Summit, the brightest minds in TradFi and DeFi will dive into tokenization, credit, and crypto.

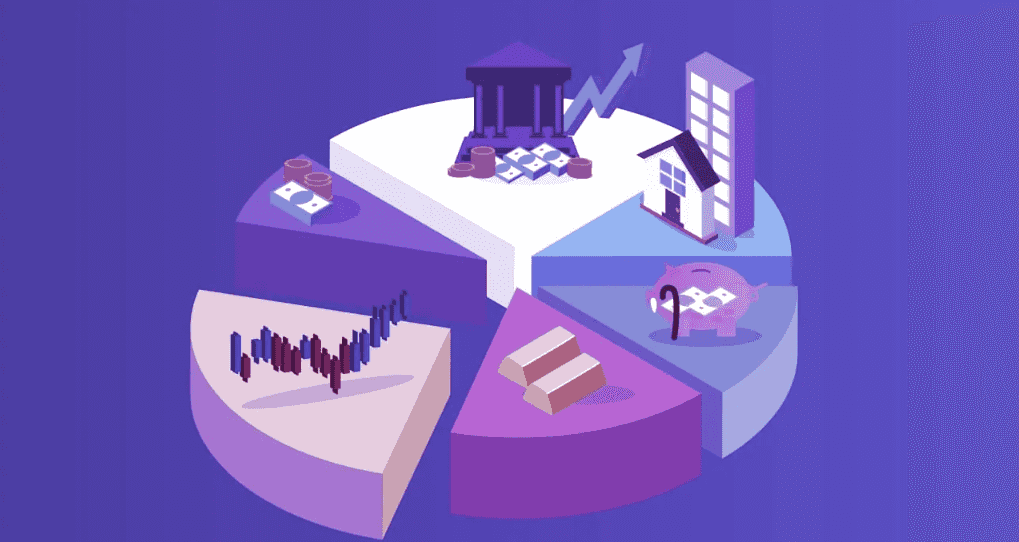

Everything DAOs, stablecoins, and protocols need to onboard real-world assets.

Prime Platform Offers Legal And Technical Infrastructure.

The new Centrifuge App is here, succeeding Tinlake and making it easier than ever to jump into real-world assets onchain.

Facu Peláez of karpatkey and Cassidy Daly of Centrifuge discuss Real-World Assets, DAO treasuries, and risk management in this episode of DeFi Drip.

The crew laying the rails, putting real-world assets on-chain, could end the Wild West stigma in crypto, eventually retiring Wall Street's old hat and outlasting crypto's black hats.

DeFi platform Centrifuge is unlocking 'affordable access to capital' with Real-World Assets, helping small businesses access DeFi liquidity.

Real World Assets (“RWAs”) are assets that exist off-chain, but are tokenized and brought onchain to be used as a source of yield within DeFi.

A draft proposal to integrate Centrifuge infrastructure with GHO is in the works

RWA Isn’t Just a Buzzword But a Catalyst for a Decentralized Financial System

DeFi Drip, hosted by Cassidy Daly from Centrifuge, is a series talking about all things coffee and changing the world of finance. Episode 3 features Chuck Mounts, Chief DeFi Officer at S&P Global.

Co-founder Lucas Vogelsang on How Any Asset Can go On-Chain and the Rise of RWAs

The Centrifuge Credit Group are seasoned credit experts with specializations in different asset classes. They will provide the Centrifuge community and our partners with unbiased and objective reviews of pool onboarding proposals.

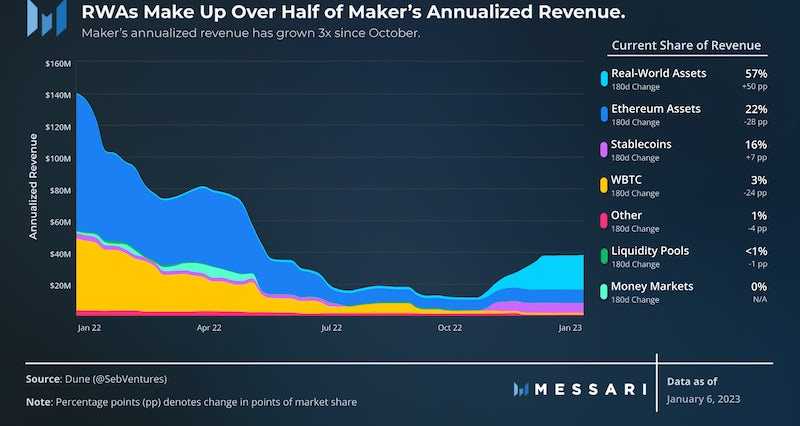

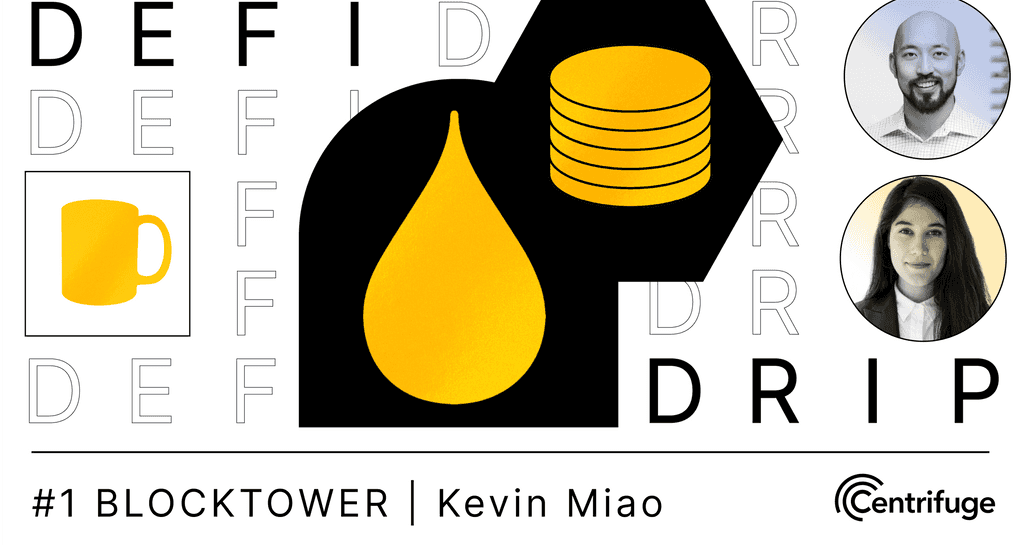

In late December, BlockTower Credit became the first institutional credit-fund to be approved to bring their collateralized lending operations on-chain through a partnership with Maker and Centrifuge.

Leading Crypto Exchange Says Tie-ups Between DeFi and TradFi Assets to be Major Trend in 2023

MakerDAO has approved four RWA vaults that will finance real-world assets originated by BlockTower — all issued on-chain through Centrifuge

A $220 million “real-world asset” vault may soon be available to DeFi investors

DeFi Drip, hosted by Cassidy Daly from Centrifuge, is a series talking about all things coffee and changing the world of finance. Episode 2 features Sébastien Derivaux, contributor to MakerDAO.

Decentralized finance protocol Centrifuge has raised $4 million in a strategic round from backers Coinbase Ventures, BlockTower, Scytale and L1 Digital.

Centrifuge, a decentralized finance protocol for putting real-world assets on the blockchain, raised $4 million in new funding from strategic investors.

To Centrifuge CEO and cofounder Lucas Vogelsang, decentralized finance (DeFi) is "the future of the financial system" here, in the now — filling a niche that traditional finance has largely found not worth its time.

DeFi Drip, hosted by Cassidy Daly from Centrifuge, is a series talking about all things coffee and changing the world of finance. Episode 1 features Kevin Miao, Head of Credit at BlockTower.

Real-World Asset issuers and investors are the lifeblood of Centrifuge. Let's explore how issuers and their pools work!

Today we're going to explore a common question about Tinlake and Real World Asset (RWA) financing: what happens in a default?

RWA Market uses the Aave Protocol to bring more liquidity to Centrifuge assets.